“We have already detailed you about EPF offices and how to check the status online. Now this article will step by step guide you and help you to understand the process of Claiming (Withdrawing) or Alternatively transferring your EPF (Employee Provident Fund) money, be you in Mumbai or any city. The rules and process applied everywhere in India..”

This article is not updated. Kindly Contact the EPF department for updated Process.

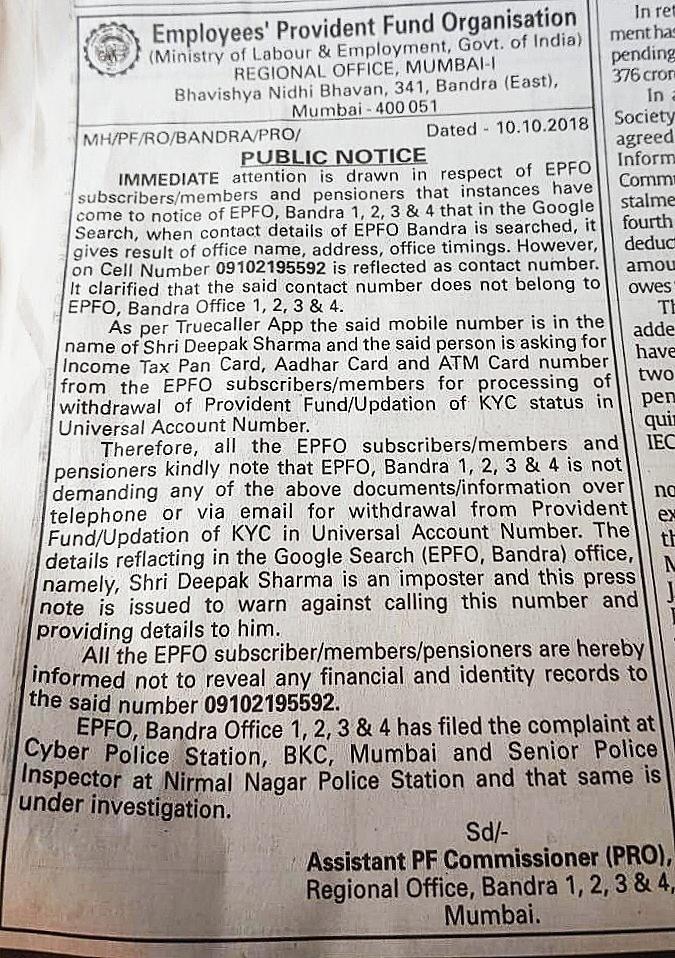

ALERT !!! (October 2018) – Fraudsters Out There (See Below Image)

“IT IS HIGHLY RECOMMENDED TO CONTACT LANDLINES OF UPDATED CONTACT NUMBERS AT EPFO WEBSITE.”

Jump to Process : [ EPF Withdraw Process ], [ Process of PF Transfer and Claim ], [ Updates ]

Updates February 2016 : Changes in withdrawal rules and policy lately by retirement fund governing body (EPFO) has sadden many individuals who had already planned on how to use and invest the funds received upon retirement at the age 55 / 56. As major organization considers retiring age of 58, the old fund withdrawal policy (retirement scheme) at age 54 is no more applicable where one claimed 90% of the provident fund amount. As per new rules, the funds will not be given till age 58, but optionally one can withdraw and claim his own contribution and interest achieved on same as compared to full 90% amount as per old scheme.

EPF Withdraw Process

- Fill a simple form 19 which is available on EPF India Website

- Submit the duly filled form to your previous Employer Human Resource or Account Department.

- In case your previous company is shutdown, Or for any reasons you don’t want to communicate with them, It is still possible for you to withdraw your hard earned money with EPFO. Simply go to your Bank and request Branch Manager to make the Form 19 ATTESTED and submit to near by PF office. The process of attesting the document is mandatory, which means Bank Manager identifies your Personal and Contact details which is required by you as a Claimer.

Process of PF Transfer and Claim

- Remember, You get interest on your untouched PF money which is lying with EPFO. But now it limits of adding interest to unclaimed accounts or account which are not active to only 3 years. So as soon as possibly get your account transferred with current working employee and keep it active to get Interest benefits. As you might know with your contribution is added the employers too, Which means a great old age money or future investment is with you right now, and i am sure you will not like to waste or mess with it. Below are the steps to follow for transfer process.

- Goto EPF website Online Transfer and Claim Section and Register.

- Next step is to check if you are eligible by checking which of the Employers has already registered with EPF INDIA and has a Digital Signature to do the needful.

- Next, PF Officials with start the claim / transfer process.

- Now get this verified online from either of your Employers (previous or latest).

- Once done with verification, Fill up the Claim form. And If you are not verified, you need to take some pain of interacting with officers by personally going to EPF office and doing the complete process offline.

- Get those forms etc, Fill it and give it to your current Employer, That’s it.

See More in Services